Aloha friends! As we settle into the holiday season and look forward to cooler evenings and festive gatherings, it’s a great time to check in on how the Oʻahu real estate market is shaping up. November’s numbers show a blend of opportunity and caution—so let’s dive into what’s happening across our island neighborhoods.

Key Takeaways

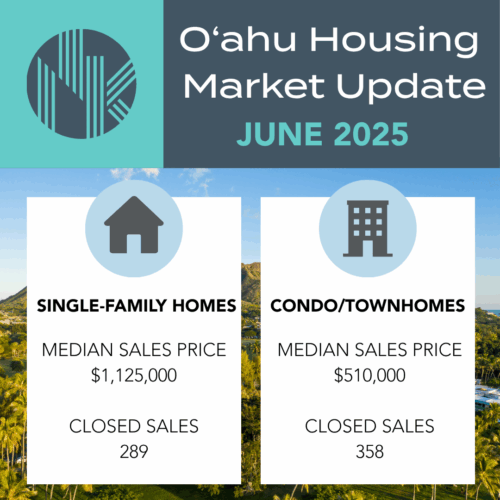

- Single-family home sales jumped 18.7% compared to last November, with 241 homes sold. This is a strong sign of buyer interest, especially in the mid- and high-end price ranges.

- Median price for single-family homes dipped slightly to $1,100,000 (down 1.3% year-over-year), but the year-to-date median is up 3.8%—showing overall price stability.

- Condo sales fell 7.3% to 316 units, and the median price dropped 8% to $487,450. Most activity was in the more affordable $100,000–$399,999 range.

- Homes are taking longer to sell: Median days on market rose to 27 for single-family homes and 40 for condos.

- Inventory is shifting: Active single-family listings dropped 3.3%, while condo inventory rose 11.5%, especially in Central Oʻahu and Waipahu.

- Pending sales are up: Single-family homes (+12.4%) and condos (+3.7%) both saw more properties under contract, hinting at steady buyer demand.

How you feel depends on where you are

The market is showing its seasonal rhythm—single-family homes are seeing a burst of activity, especially in the $800,000–$899,999 and $2 million-plus ranges. This could be a sign that buyers are feeling confident heading into the new year, perhaps motivated by stabilizing interest rates and the desire to settle before 2026. On the condo side, affordability is driving sales, but higher-priced units are seeing less movement, which is pulling down the median price.

For sellers, competitive pricing and presentation remain key, especially as homes are spending more time on the market. Buyers have more choices in the condo market, but single-family inventory is tightening, especially in popular neighborhoods like Central Oʻahu and Waipahu.

You can call on me

Whether you’re thinking about making a move or just curious about what these trends mean for your neighborhood, I’m here to help. Want to talk about what this means for your real estate plans? Feel free to reach out—I’d love to connect and chat about your options!