During today’s Metro Regional Meeting for the Honolulu Board of Realtors, guest speaker Sumner La Croix, Professor Emeritus from the University of Hawaii Economic Research Organization (UHERO), gave us attendees an update an outlook on the current local economy. I’ve distilled the whole presentation down to the major points, so reach out if you want to talk more.

Robust outlook expected nationwide

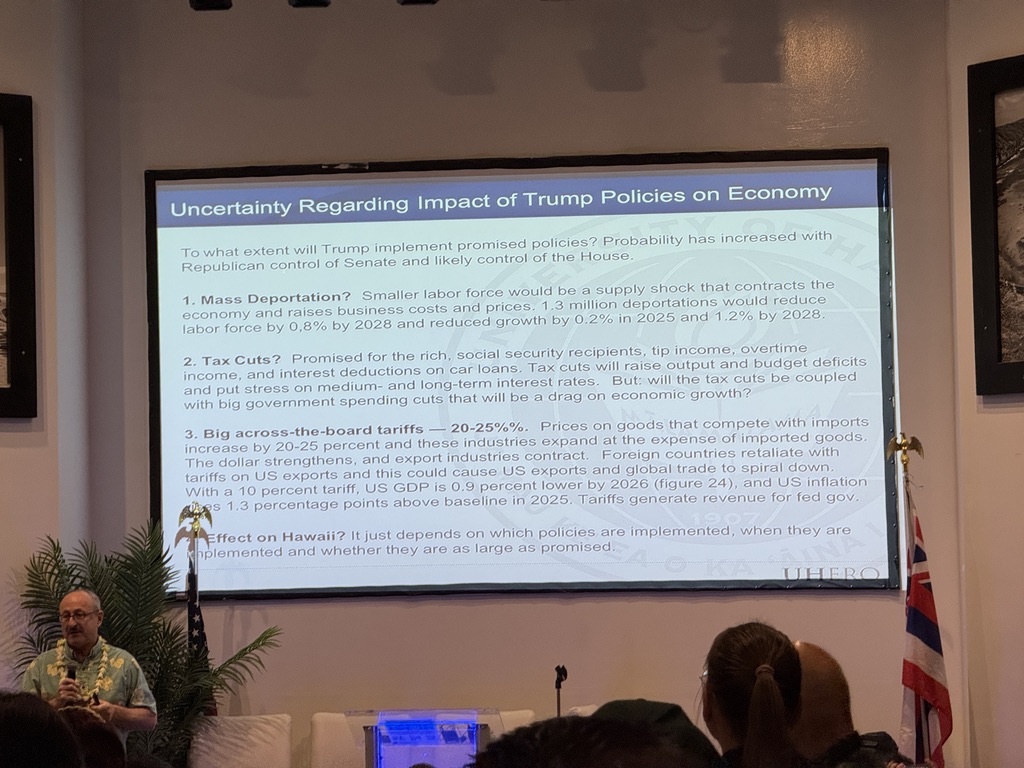

Overall, Sumner stated that, in spite of how it “feels,” the overall market should be fairly robust and growth is expected to continue at it’s normal 3% pace annually. Depending on what economic policies are actually enacted once President Trump takes office, there could be issues affecting our local economy that we need to monitor.

Mass deportation will affect Hawaii economy directly

Basically, deportation of workers in places like California, Nevada, and Arizona will create a vacuum of job migration to the mainland. Local workers in industries like tourism and construction will be drawn to the mainland when the lack of workforce creates a higher demand there.

Tax cuts will put stress on medium and long-term interest rates

President Trump’s proposed tax cuts will raise output, leading to a bigger deficit, and put stress on interest rates. Tax cuts would also need to be paired with spending cuts, putting a damper on economic growth, and possibly leading to even higher interest rates.

Tariffs could put further strain on international tourism

Outside of the direct increase that tariffs would have on nationwide inflation, it would raise the value of the dollar internationally. If that happens, the international tourist may seek other cheaper destinations instead of Hawai‘i, including real estate purchases.

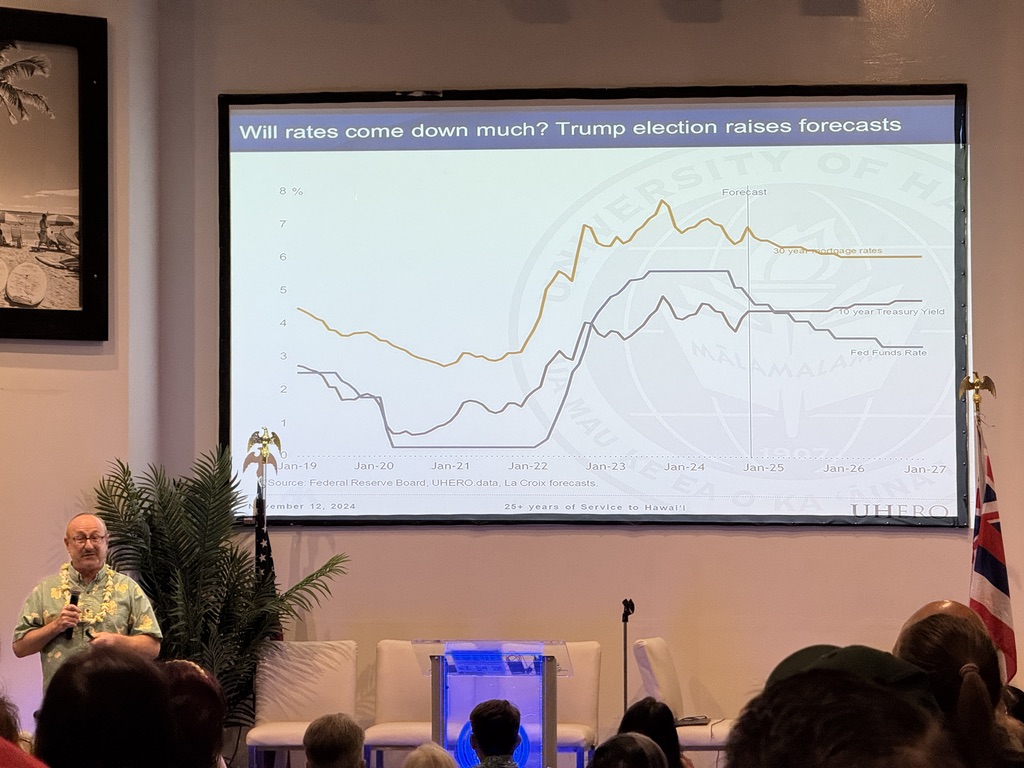

Economic policies will not lower interest rates as far as expected

With inflation expected to continue to rise under President Trump’s economic policies, we will also see mortgage interest rates settle around 6% nationwide. UHERO expects 10-year treasury yields to grow as well, alongside a falling federal funds rate.

Statewide, economic weakness is Maui

Overall, visitors are about 80% back since the wildfire on Maui. While all other islands have seen growth since then, Maui continues to drag the state’s overall economy down as it still recovers.

State population also expected to fall in near future

A population decline is expected, which leads to a shrinking labor force and less homebuyers.

Japanese tourism still down

Tourism from Japan is still about 40% of what it was pre-COVID, and is expected to continue struggling amid rising dollar strength (weakening Yen) and more affordable destinations.

Construction expected to offset tourism downswing

Thanks to several large government construction projects in the works, UHERO expects the local economy to be stable amid the tourism slowdown. The projects are only scheduled through 2028, so forecasts after that are weaker.

Regulatory costs are third highest in the nation

According to a recent UHERO study, Hawaii ranks third in the nation among highest regulatory costs in new condo construction. UHERO estimates that roughly $400,000 is added on to the cost of constructing a condo due to delays from permitting and archaeological examinations.

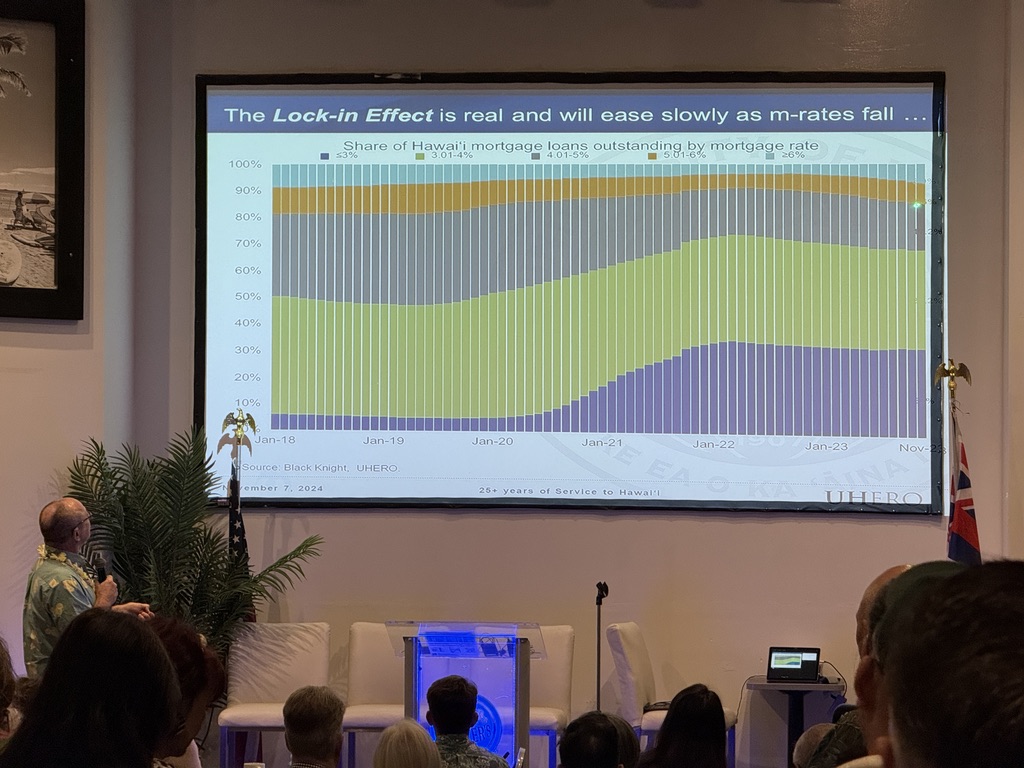

Locked-in mortgages will strain resales

Since January 2022, roughly 30% of all mortgage loans on the island have less than a 3% rate. It was closer to 5% pre-COVID. With rates above 6% now, it will be harder for homeowners to make a flip into a new property at the higher rate, so more owners are expected to hang on to their current mortgage longer than traditionally.

Overall outlook not as strong locally

Maui rebuilding and government construction projects will grow Hawaii GDP in the short term. However, if foreign tourists continue to struggle amid a strengthening dollar, then Hawaii will struggle to maintain good economic standing after those construction dollars have run out. Pairing that with expected rising inflation under President Trump’s economic policies and the rising costs of insurance locally, will put a strain on our economy in the long-term.

This outlook is in line with what we’ve been seeing within the real estate market. We had hoped that interest rates would fall a little further than what UHERO is outlaying, but a settling rate is better than a rising rate, especially as more Sellers will sit on the fence with their sub-3% interest rate locked in.

If you would like more information about any of these points, feel free to reach out and let me know!

Leave a Reply